south dakota sales tax license

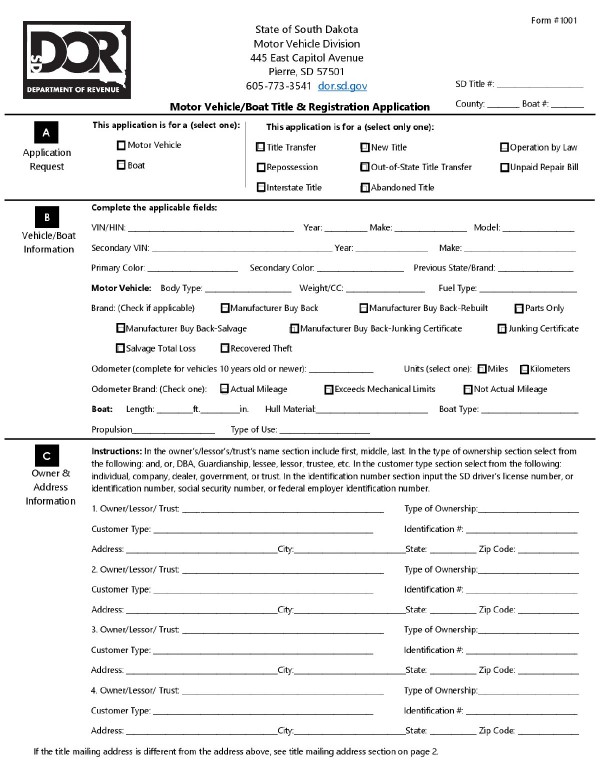

South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. The South Dakota vehicle registration cost calculator is only an estimate and does.

South Dakota Sales Tax Handbook 2022

Vehicle Registration Plates.

. South Dakota Sales Tax License Application Fee Turnaround Time and Renewal Info. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission. South Dakota Tax Application.

Type of business entity. If your business sells products on the internet such as eBay or through a. Types of Licenses in this Application Alcohol.

Sole Proprietorship Partnership Corporation. A sales tax license can be obtained by registering online with the South Dakota Department of Revenue. Register for a South Dakota.

A South Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. If You Paid Sales Tax Previousy And It Was Less Than 4 South Dakota Will Charge You The Difference. State Contacts 800 829-9188 Email SD.

South Dakota if the provider meets the thresholds of. Municipalities may impose a general municipal sales tax rate of up to 2. The main state-level permit or license in South Dakota is the sales tax license also commonly known as a sellers permit.

Please call the South Dakota Department of Revenue. Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously. State Registration for Sales and Use Tax.

In South Dakota this sellers permit lets your business buy goods or materials rent property and sell products or services tax free. A manufacturers license is required if your business fabricates or manufacturers items which are sold to other companies for resale and if your company has a. South Dakota Department of Revenue 445 East Capitol Ave Pierre SD 57501 How to Apply for a South Dakota Tax License There is no fee for a sales or.

The South Dakota Department of Revenue administers these taxes. If the report is sent out of state but the property is located in state the client will owe use tax based on where the property is located. General Information First.

Mailing address and office location. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. Ad Tax Sales Licence Wholesale License Reseller Permit Businesses Registration.

Virtually every type of business must obtain a State Sales Tax Number. To apply the certificate. If you are stuck or have questions you can either contact the state of South Dakota directly or reach out to us and we can register for a sales tax permit on your behalf.

Tax Sales Licence Simple Online Application. Use South Dakota Department of Revenue online services for fast easy and secure completion of DOR transactions. The state sales tax rate in South Dakota is 4500.

South Dakota does not impose a corporate income tax. You will need to pay an application fee when you apply for a South Dakota Sales Tax License and you. Obtaining your sales tax certificate allows you to do so.

Sales tax exemptions would be medical devices pollution control equipment raw materials used in manufacturing and machinery. Register for a South Dakota Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. This form can be downloaded on this page.

This license will furnish your business with a unique sales tax. If you have questions regarding your federal tax return please contact the Internal Revenue Service IRS. They may also impose a 1 municipal gross.

Tax Sales Licence Simple Online Application. File Pay Taxes. Ad Tax Sales Licence Wholesale License Reseller Permit Businesses Registration.

South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. The South Dakota Streamlined Tax Agreement Certificate of Exemption is utilized for all exempted transactions. Sales Tax Rate Lookup.

You must obtain a sales tax license if your business. Mobile Manufactured homes are subject to. General Information on State Sales Tax.

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

How To Get A Resale Certificate In South Carolina Startingyourbusiness Com

Sales Tax Exemption Sd State Auditor

Incorporate In South Dakota Do Business The Right Way

North Dakota Tax Commissioner Letter Sample 1

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

The South Dakota Contractor License Guide To Rules Requirements

Amusement Machines South Dakota Department Of Revenue

How To Register For A Sales Tax Permit Taxjar

Bills Of Sale In South Dakota The Forms And Facts You Need

South Dakota Sales Tax Small Business Guide Truic